Cost Segregation Studies

What Is A Cost Segregation Study?

An Engineering-Based Cost Segregation study is a set of calculations created by an independent firm with extensive tax and construction knowledge. At CSSI®, we create an Engineering-Based Cost Segregation study by analyzing your building and its assets within U.S. tax code guidelines. When an engineering-based study is performed, actual cost records and construction documents are reviewed, when available, and a site visit is completed.

A quality cost segregation study should include the 13 points outlined within U.S. tax code. Our methodical approach identifies individual components of your commercial property, which are included in your detailed cost segregation study.

How Does A Cost Segregation Study Work?

At CSSI, we perform an analysis of the building looking for up to 100 building components that are really an earlier depreciation life. The study places building components in their proper life categories such as 5-, 7-, and 15-year rather than conventional 27.5- and 39.5-year schedules. This Engineering-Based Cost Segregation study results in a much higher depreciation expense and significantly reduced taxable income for the property owner.

Most buildings are depreciated over 27.5- or 39-years. A cost segregation study re-categorizes a portion of your building into 5-, 7- or 15-year class lives. When the usable lives of these items are accelerated, income is reduced, thus, reducing income tax liability.

Within the first five years of building ownership, you could save up to $100,000 for every $1 million in building costs. Cost Segregation has been recommended by the AICPA and many leading financial publications, including the Journal of Accountancy.

Who Can Benefit from Cost Segregation?

Owners of both commercial and residential rental properties can benefit from CSSI. All properties that have been owned for 15 years or less could be eligible for a tax benefit through Cost Segregation. Typically, the minimum purchase price that makes sense for an owner is around $150,000. In addition, it is recommended the owner hold the property for at least 3 years to prevent additional recapture upon sale.

Property Types

- Warehouses

- Apartments

- Retail Units

- Restaurants

- Offices

- Medical Facilities

- Self-Storage

- Hotels

- Golf Courses and Stadiums

- Short-Term Residential Rentals

- Long-Term Residential Rentals

- Airbnb's

How Does Cost Segregation Services Get You the Highest Tax Savings?

We evaluate your building from both an engineering-based and financial standpoint. We provide you accurate calculations, and we work with your tax professional to implement our study results. We have helped commercial property owners across the nation save on buildings with a cost of $150,000 to $1.5 billion in almost every industry.

Reduce Your Taxable Income

By utilizing accelerated depreciation, your income is reduced, which immediately impacts your federal income tax payment. Our cost segregation studies help you get the maximum tax deductions while staying compliant with U.S. tax code.

Grow Your Business

What you do with that money is up to you. Many of our clients use their tax savings to reinvest in their business, purchase additional property, or pay off their principal building payment.

Keep More of Your Money

With less taxable income, you decrease the amount of income taxes you pay. Our cost segregation studies enable you to keep more of the money you make.

Why CSSI

CSSI has completed over 30,000 studies in all 50 states since 2003. Our calculations are accurate and defendable because our in-house tax council and seasoned analysts are the best in the country. In addition, we offer some of the best pricing in the market. Our fee includes travel costs, audit defense, and a building systems guide that can be used to stay in compliance with the new Tangible Property Regulations. Future expenditures can be compared to these numbers on the report whether to expense or capitalize them. Our accounting team offers audit defense should the IRS have any questions about the study. In addition, we can provide a 3115 form for those properties purchased in a year other than the year the study is done for. We work side by side with the CPA or Tax Professional, to ensure a smooth process in obtaining the client's tax benefit.

Webinar with MidasIQ helping owners and CPA's understand Cost Segregation

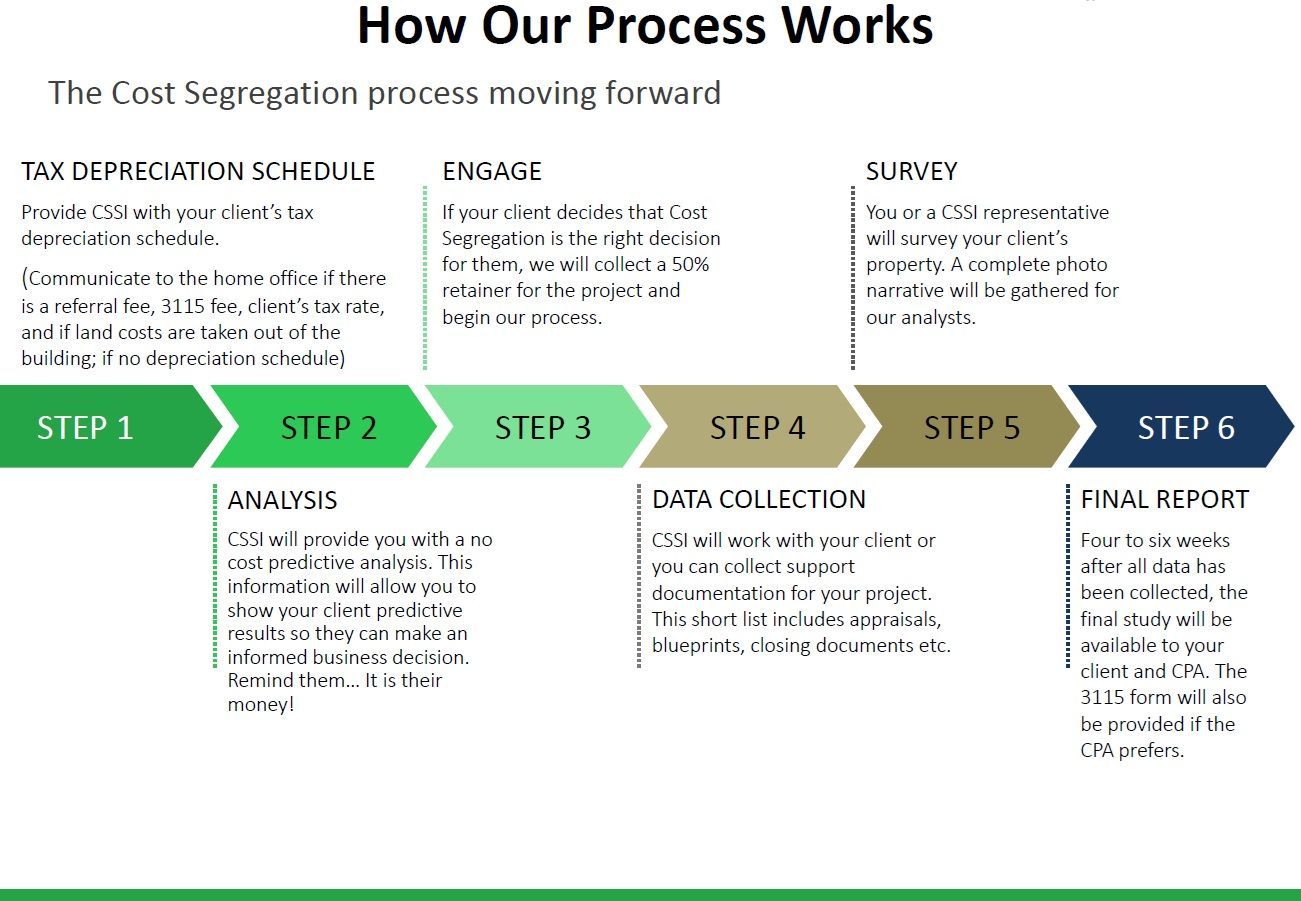

Our Process

Step 1: Analyze

Request your complimentary CSSI® Property Analysis. This is a preliminary review that includes:

- Increased cash flow analysis

- Net present value of the savings

- An associated cost and simple process outline to complete the study

Step 2: Review

Upon engagement, CSSI® will:

- Consult with you and your tax professional regarding your tax savings

- Evaluate the building’s construction costs by component and building systems

- Review all construction documents, including blue prints, as-built drawings, demolition plans, and available project specifications

- On-site inspection and walk-through to photographically document building components, systems, site improvements, and any renovations

Step 3: Complete

Your CSSI® Study is performed and completed within approximately six weeks. This includes:

- Reclassifying each building component into more appropriate tax lives as prescribed by tax code guidelines

- Allocating indirect costs to each asset

- Delivering a written report with the asset detail supporting the reclassification and completion of the necessary tax forms

- Assisting your tax professional in the completion of all applicable tax forms

For a No Cost, No Obligation Estimate:

Simply call (833) 940-5557 to discuss your needs.